american express business loan rates

When it comes to financing your business, finding the right loan with favorable terms and rates is crucial. American Express is a well-known and trusted financial institution offering a range of business loan options. In this article, we will delve into the details of American Express business loan rates, helping you make an informed decision for your business's financial needs.

In this guide, we will break down the various factors that influence American Express business loan rates, such as creditworthiness, loan duration, and loan amounts. Additionally, we will explore the different types of business loans offered by American Express, including term loans, lines of credit, and merchant financing. By understanding these key factors, you will be better equipped to assess the rates and terms that best suit your business's unique circumstances.

Understanding American Express Business Loan Rates

Factors that Influence Business Loan Rates

When considering American Express business loan rates, it's essential to understand the factors that influence them. These factors include the borrower's creditworthiness, the loan duration, and the loan amount. American Express evaluates these factors to determine the risk associated with lending to a particular business and adjusts the interest rate accordingly.

Creditworthiness: Your business's creditworthiness plays a significant role in determining the interest rate you qualify for. American Express assesses your business's credit history, including factors such as payment history, outstanding debts, and credit utilization. A higher credit score indicates a lower risk, leading to more favorable loan rates.

Loan Duration: The duration of the loan also affects the interest rate. Generally, longer-term loans may have slightly higher rates compared to shorter-term loans due to the increased risk associated with extended repayment periods. However, American Express offers competitive rates across various loan durations to accommodate different business needs.

Loan Amount: The loan amount requested by your business can impact the interest rate offered by American Express. Higher loan amounts may have slightly higher rates due to the increased risk for the lender. However, American Express strives to provide competitive rates regardless of the loan amount, ensuring accessibility for businesses of all sizes.

Improving Your Chances of Securing Favorable Rates

While American Express determines loan rates based on various factors, there are steps you can take to improve your chances of securing more favorable rates. Here are some key strategies:

Strengthen Your Credit Profile: Maintaining a strong credit profile is essential. Ensure that your business pays bills on time, reduces outstanding debts, and maintains a healthy credit utilization ratio. Regularly review your credit report to identify any errors and take steps to rectify them promptly.

Show Strong Financials: Demonstrating healthy financials, such as consistent revenue growth and positive cash flow, can help you secure better loan rates. Lenders, including American Express, want to see that your business is financially stable and capable of repaying the loan.

Provide Collateral: Offering collateral, such as business assets or personal guarantees, can reduce the perceived risk for lenders. Collateral provides security for the loan and may result in more favorable terms and rates.

Types of American Express Business Loans

Term Loans

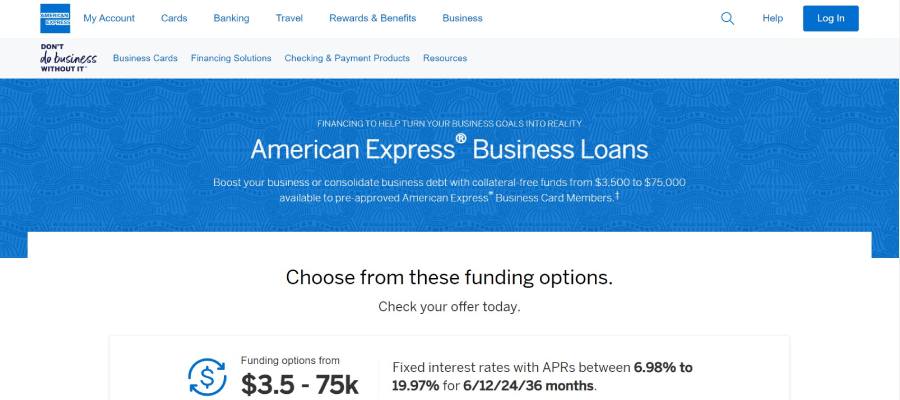

American Express offers term loans, which are a popular choice for businesses looking for a lump sum of capital to be repaid over a predetermined period. Term loans usually have fixed interest rates and regular monthly payments. These loans can be used for various purposes, such as expanding operations, purchasing equipment, or refinancing existing debt.

With American Express term loans, you have the flexibility to choose repayment terms that align with your business's cash flow. The loan amount, loan term, and creditworthiness will influence the interest rate offered. American Express provides competitive rates to ensure that businesses can access the necessary capital at reasonable terms.

Lines of Credit

American Express lines of credit offer businesses a flexible financing option that allows them to access funds as needed. Similar to a credit card, a line of credit provides a predefined credit limit. Businesses can draw funds from the line of credit whenever necessary and only pay interest on the amount borrowed.

Lines of credit are particularly useful for managing short-term working capital needs, covering unexpected expenses, or taking advantage of opportunities as they arise. American Express offers competitive rates on lines of credit, ensuring that businesses can access funds quickly and cost-effectively.

Merchant Financing

Merchant financing, also known as business loans against future sales, is a specialized loan option offered by American Express. This type of financing is tailored for businesses that generate revenue through credit and debit card sales. Instead of fixed monthly payments, repayments are made through a percentage of future card sales.

American Express merchant financing offers businesses the flexibility to repay the loan based on their monthly sales volume. This allows businesses to manage their cash flow effectively, especially during periods of fluctuating sales. The interest rates for merchant financing are competitive, and the loan amount offered depends on the business's card sales history.

Applying for an American Express Business Loan

Eligibility Requirements

Before applying for an American Express business loan, it's important to ensure that your business meets the eligibility requirements. While specific criteria may vary based on the loan type, here are some general requirements:

Business Age and Legal Structure: American Express typically requires businesses to be at least one year old and have a legal structure (e.g., sole proprietorship, partnership, LLC, corporation).

Annual Revenue: The minimum annual revenue requirement varies depending on the loan type. American Express may require businesses to have a minimum annual revenue ranging from $50,000 to $200,000.

Credit Score: While American Express considers various factors when evaluating loan applications, having a strong credit score enhances your chances of approval. Aim for a credit score of 600 or higher to qualify for most American Express business loans.

The Application Process

Once you have determined that your business meets the eligibility criteria, you can begin the application process for an American Express business loan. The application process typically involves the following steps:

1. Gather Required Documentation: American Express may require documentation such as financial statements, tax returns, bank statements, and business licenses. Ensure that you have all the necessary documents ready to expedite the application process.

2. Complete the Application Form: Fill out the application form provided by American Express, providing accurate and up-to-date information about your business.

3. Submit the Application: Once you have completed the application form and gathered all the required documents, submit your application to American Express for review.

4. Wait for Approval: American Express will review your application and may request additional information if necessary. The approval process typically takes a few business days, after which you will receive a decision regarding your loan application.

5. Review and Accept the Offer: If your loan application is approved, carefully review the terms and conditions, including the loan amount, interest rate, repayment schedule, and any associated fees. If you find the offer satisfactory, accept it to proceed with the loan disbursement.

Comparing American Express Business Loans with Other Lenders

The Importance of Shopping Around

When seeking a business loan, it is crucial to shop around and compare the offerings of different lenders, including American Express. While American Express is a reputable financial institution, exploring other options allows you to find the best rates and terms for your business's specific needs.

By comparing various lenders, you can gain a better understanding of the interest rates, loan terms, repayment schedules, and additional fees or charges associated with each loan option. This knowledge will help you make an informed decision and select the lender that offers the most competitive rates and favorable terms for your business.

Understanding Other Lenders' Offerings

When comparing American Express business loans with those offered by other lenders, it's essential to look beyond interest rates alone. Consider the following factors:

Loan Amounts: Different lenders may have varying minimum and maximum loan amounts. Ensure that the lender you choose can accommodate your business's financing needs.

Repayment Terms: Compare the repayment terms offered by different lenders. Look for flexibility in repayment schedules that align with your business's cash flow and revenue cycles.

Additional Fees: Besides interest rates, lenders may charge additional fees, such as origination fees or prepayment penalties. Take these fees into account when evaluating the overall cost of the loan.

Customer Service and Support: Consider the level of customer service and support provided by each lender. Access to knowledgeable representatives and reliable support can be invaluable throughout the loan process.

Case Studies: Real-Life Examples of American Express Business Loan Rates

Case Study 1: A Growing Retail Business

XYZ Retail is a growing business that specializes in selling unique handmade products. The business required a loan to expand its inventory and open a new store location. After reviewing various lenders, XYZ Retail decided to apply for an American Express term loan.

Giventhe business's healthy credit profile and strong financials, XYZ Retail was able to secure a competitive interest rate from American Express. The loan amount and term were customized to meet the specific needs of the business, allowing XYZ Retail to access the necessary capital while keeping the loan payments manageable within their budget.

Case Study 2: A Seasonal Business

ABC Resort is a seasonal business that experiences fluctuations in cash flow throughout the year. The business needed a line of credit to cover expenses during the off-season and invest in marketing initiatives for the peak season. After careful evaluation of different lenders, ABC Resort opted for an American Express line of credit.

American Express offered ABC Resort a flexible line of credit with competitive rates. This allowed the business to access funds when needed, ensuring smooth operations during the off-season and the ability to seize growth opportunities during the peak season. The interest rates and repayment terms were tailored to match the business's revenue cycles, making it a suitable financing solution for ABC Resort's unique needs.

Tips for Negotiating Lower American Express Business Loan Rates

1. Strengthen Your Business's Financials

Prioritize improving your business's financial health by focusing on increasing revenues, reducing expenses, and maintaining a positive cash flow. By demonstrating financial stability and growth potential, you can negotiate for better loan rates.

2. Leverage Your Existing Relationship with American Express

If you already have a positive history with American Express, such as being a long-time customer or having a good payment record on your business credit card, leverage that relationship. Highlight your loyalty and responsible financial behavior as factors that support your request for lower loan rates.

3. Provide Collateral or Personal Guarantees

If your business has valuable assets or you are willing to provide personal guarantees, it can significantly reduce the perceived risk for American Express. This may result in lower interest rates and more favorable loan terms.

4. Compare Offers and Use Them as Leverage

Research and gather loan offers from other lenders to use as leverage during negotiations with American Express. Having alternative options gives you more bargaining power and may prompt American Express to offer more competitive rates to retain your business.

5. Seek the Assistance of a Financial Advisor

If negotiating loan rates is unfamiliar territory for you, consider consulting a financial advisor or business consultant who can provide guidance and help you navigate the negotiation process. Their expertise can potentially lead to better outcomes and lower loan rates.

Frequently Asked Questions about American Express Business Loan Rates

1. Are American Express business loans only available to American Express cardholders?

No, American Express business loans are available to both existing American Express cardholders and non-cardholders. While having an American Express card may provide certain advantages, such as faster application processing, it is not a requirement to qualify for a business loan.

2. Can I use an American Express business loan to consolidate my existing debts?

American Express offers term loans that can be used for debt consolidation. By consolidating your existing debts into a single loan with more favorable terms, such as a lower interest rate or longer repayment period, you can potentially reduce your overall debt burden and simplify your finances.

3. How long does it typically take to receive the funds after loan approval?

The time it takes to receive the funds after loan approval may vary depending on various factors, including the loan type and the completeness of your documentation. In general, American Express strives to disburse funds as quickly as possible, often within a few business days of loan approval.

4. Can I make additional payments or pay off the loan early without any penalties?

Yes, American Express typically allows borrowers to make additional payments or pay off the loan early without imposing any prepayment penalties. However, it's always essential to review the loan agreement and consult with American Express to confirm the specific terms and conditions regarding early repayment.

Final Thoughts on American Express Business Loan Rates

In conclusion, understanding American Express business loan rates is crucial for making informed decisions regarding your business's financing needs. By comprehending the factors that influence loan rates, exploring the different loan types offered by American Express, and comparing their offerings with other lenders, you can secure the most favorable terms and rates for your business.

Remember to strengthen your credit profile, provide collateral if possible, and leverage your existing relationship with American Express to negotiate lower rates. Additionally, seeking the guidance of a financial advisor and comparing loan offers can enhance your chances of securing the best loan rates available.

Always assess your business's unique circumstances and financial goals when selecting a loan. By carefully considering all the factors discussed in this comprehensive guide, you can confidently navigate the world of American Express business loan rates and find the financing solution that propels your business's growth and success.

0 Response to "american express business loan rates"

Posting Komentar